Paul Schmelzing, Harvard University.

Paul Schmelzing is a visiting scholar at the Bank from Harvard University, where he concentrates on 20th century financial history. In this guest post, he looks at the current bond market through the lens of nearly 800 years of economic history.

Paul Schmelzing is a visiting scholar at the Bank from Harvard University, where he concentrates on 20th century financial history. In this guest post, he looks at the current bond market through the lens of nearly 800 years of economic history.

The economist Eugen von Böhm-Bawerk once opined that “the cultural level of a nation is mirrored by its interest rate: the higher a people’s intelligence and moral strength, the lower the rate of interest”. But as rates reached their lowest level ever in 2016, investors rather worried about the “biggest bond market bubble in history” coming to a violent end. The sharp sell-off in global bonds following the US election seems to confirm their fears. Looking back over eight centuries of data, I find that the 2016 bull market was indeed one of the largest ever recorded. History suggests this reversal will be driven by inflation fundamentals, and leave investors worse off than the 1994 “bond massacre”.

Bond “bull markets” since 1285

Chart 1: The Global risk free rate since 1285

As a contemporary of fin-de-siècle Vienna, Böhm-Bawerk witnessed a period of unprecedented internationalization, deepening trade relations, and technological innovation – associated with the parallel financial phenomena of the expansion of London-based merchant banks, and the growth in global capital mobility(triggering the heyday of the “cash nexus”). At this point, yields on the global “risk free bond” – then British consols – had fallen to an all-time low of 2.48% in 1898 (Chart 1). But not least his own enthusiasm should prove short-lived: soon after his writing, rates entered what Richard Sylla and Sidney Homer later defined as the “first bear bond market”.

Indeed, judging purely by historical precedent, at 36 years, the current bond bull market had been stretched. As chart 2 shows, over 800 years only two previous episodes – the rally at the height of Venetian commercial dominance in the 15th century, and the century following the Peace of Cateau-Cambrésis in 1559 – recorded longer continued risk-free rate compressions. The same is true if we measure the period by average decline in yields per annum, from peak to trough. With 33 bps, only the rallies following the War of the Spanish Succession, and the election of Charles V as Holy Roman Emperor surpass the bond performance since Paul Volcker’s “war on inflation”.

Chart 2: Length and size of bull markets since 1285

Modern bear shock markets, 1925-2016

It thus appears timely to ask about the characteristics of bear bond markets. Since Homer and Sylla’s first bear market, on our count the United States (the current issuer of the global risk-free asset) experienced 12 modern “bond shock” years, during which selloff dynamics cost long-term sovereign bond creditors more than 15% in real price terms.

Aggregating these bear markets (chart 3), we find that, at 6.1% CPI year-on-year on average, “bond shock years” record inflation levels almost double the long-term trend, at 3.1%. Global growth equally is below average, though not in recession territory. Interestingly, during bond bear markets, US federal deficits, with 2.3% of GDP, actually fall slightly below the post-1945 average track record of 2.9%. An increase in the supply of bonds, therefore, seems not decisive to the weakening in price levels.

Chart 3: Macroeconomic outcomes in bear markets

Bond turbulence, however, has traditionally struck investors in different shapes – especially since the time of Homer/Sylla’s first bear market. Below we present three types of modern bear bond case studies to illustrate that – while historically inflation acceleration has been a solid predictor of sharp bond selloffs – some prominent episodes appear less correlated with fundamentals, and can inflict similar levels of losses.

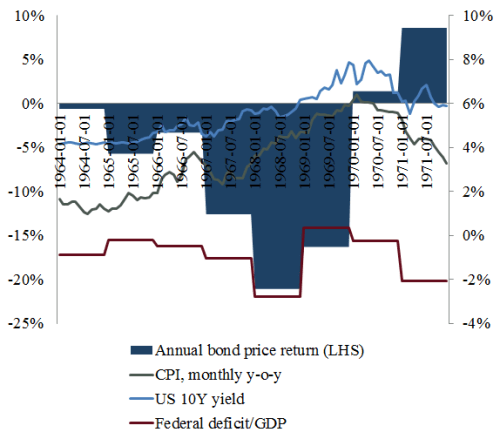

Type 1: The inflation reversal, 1967-1971

The “inflation reversal” leaves bondholders particularly bruised, and is most clearly associated with fundamentals: namely a sharp turnaround in realized consumer price inflation (CPI). This scenario correctly weighs on the minds of today’s reflationists. US bonds lost 36% in real price terms during 1965-1970, slightly outstripping losses during the 20th century’s first bear market (Chart 4). Annual CPI more than tripled in the same timeframe, from 1.6%, to 5.9%. Looser fiscal policies seem to have played only a secondary role in the 1965-70 bond sell-off, though the Vietnam War put some unexpected pressure on the federal budget. The deficit widened from just 0.2% in 1965, to 2.8% three years later – but USTs continued to decline when public finances swung back into positive territory.

Chart 4: The bear market of 1967-71

Type 2: The Sharp Reversal, 1994

The 1994 “bond massacre” has attracted particular attention of late, and represents a second type of reversal, characterized by steep, but short-lived turbulence that is associated more with financial sector leverage and exogenous positioning – rather than macro fundamentals.

After bottoming in the autumn of 1993, US bond market yields started ascending quickly, even amid discount rates on a 30-year low. A rollercoaster performance followed, which saw bond volatility surge to levels not seen since the Volcker inflation fight. However, US bonds were firmly back in bull territory by 1995, adding 18.1% in prices after inflation.

Neither inflation expectations – which peaked at an unexciting 3.4%– nor fiscal policies, which remained on the steady Clinton consolidation path, offer satisfactory explanations for the rout. Though journalistic accounts link the sell-off with the Fed’s February 1994 decision to raise short-term rates, closer investigations suggest a loose correlation at best. As the data proves, volatility in US 10 year bonds started rising in Q3-1993, while official discount rates were only raised in May 1994 – at a time when volatility had almost peaked already (Chart 5).

Chart 5: The “Bond Massacre” of 1994

Evidence from the financial sector rather suggests that the dramatic increase in leveraged bond positions by both US hedge funds and mundane money managers set in motion self-reinforcing liquidations once uncertainty over emerging markets including Turkey, Venezuela, Mexico, and Malaysia – all of which experienced sharp capital flow volatility – put pressure on speculative positions. Against current predispositions, it seems unlikely a sell-off today would trigger only a brief spark in volatility, and soon revert to the secular post-1981 trajectory.

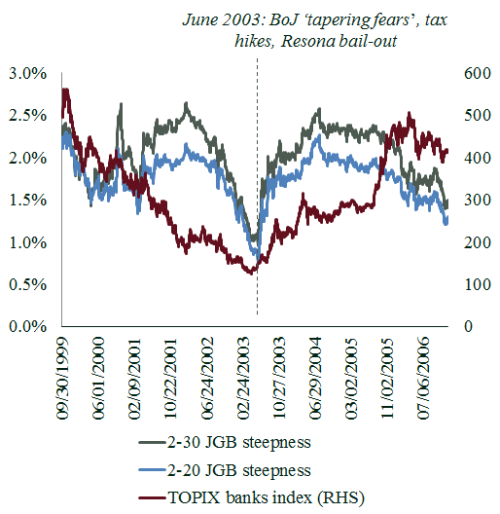

Type 3: The VaR shock, Japan 2003

But as our third type illustrates, bond turbulence can be highly discriminatory across maturities. Given the latest decision by the Bank of Japan to target long-term bond yields, after a period of unprecedented yield curve flattening, parallels emerge to the 2003 Japanese curve steepening episode, sometimes dubbed the ”Value at Risk Shock” (Chart 6). Back then, markets underwent a notable rollercoaster of the term structure against the backdrop of “tapering fears” over the BoJ’s bond buying program, the Iraq War, and domestic tax hikes.

Chart 6: The Japanese bear market of 2003

“VAR shocks” have especially deep impacts on the banking sector, whose profitability in the maturity transformation business tracks prevailing curve steepness. The dramatic flattening of the JGB term structure prior to March 2003 therefore went hand-in-hand with a sustained sell-off in the TOPIX bank index, which fell to multi year lows. Prominent financial institutions, such as Resona Group, had to be rescued through billion Dollar public bailouts.

Though the TOPIX recovered, and realized Japanese inflation only accelerated modestly, the sudden steepening of the JGB curve from the middle of 2003 posed a new set of challenges: calibrated risk management structures, known as “Value-at-Risk” models, required banks to shed JGB assets once their price started plummeting. Since most banks followed similar quantitative signals, and exerted a traditionally strong home bias in their fixed income portfolios, a concerted dumping of government bonds ensued.

Conclusions

What does the historical track record imply for current markets? A pessimistic reader could certainly identify gloomy ingredients for the “perfect storm”: the potential for a painful steepening of bond curves, after a sustained flattening as in 2003, coupled with monetary tightening; and a multi-year period of sustained losses due to a structural return of inflation as in 1967.

On the one hand, the anecdotal fear that a repeat of a 1994-type of bond crash is likely seems somewhat exaggerated, given progress on bank leverage regulations – while the current global capital flow cycle has already almost fully reversed from the cycle peak.

Type-1 and Type-3 bear markets warrant more attention. Global inflation dynamics are picking up, at a time when Central bankers voice more tolerance for “inflation overshoots”. Though currently bank equity investors are cheering the steepening of yield curves, meanwhile, the 2003 Japan episode should fix regulators’ attention on the growing home-bias in government bonds. Problematically, the IMF has warned that VAR risks have risen “significantly” in Japanese financial institutions after the financial crisis, given a continued build-up of JGB concentration in balance sheets. In Europe, the trend is equally one-directional: Italian monetary financial institutions, for instance, hold 18% of their assets in domestic government loans and securities, up from 12% in 2008. In most geographies, these bonds, despite efforts to the contrary, remain mainly held in “available-for-sale” portfolio buckets, where they have to be marked-to-market.

On balance, then, more than to a 1994-style meltdown, fixed income assets seem about to be confronted with dynamics similar to the second half of the 1960s, coupled with complications of a 2003-style curve steepening. By historical standards, this implies sustained double-digit losses on bond holdings, subpar growth in developed markets, and balance sheet risks for banking systems with a large home bias.

Paul Schmelzing is an academic visitor to the Bank from Harvard University’s History Department.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied.

Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.

As a market economist and bond strategist, I wonder out-loud as to why many, Mr. Schmelzing, tend to omit the U.S. bond market conundrum of February 2005 when postulating about the future of interest rates? Based on economic fundamentals and, for those of us on the trading floors at the time, we clearly recall longer duration government yields rising on the heels of a optimistic employment payroll report in April of 2004. Then, less than a year later, starkly watching the curves begin to flatten in the face of tightening monetary policy despite great pains by the Federal Reserve to remove accommodation at a “measured pace”. This, of course, all come to head on February 16th, 2005 when then-Chairman Alan Greenspan was forced to admit that he was less-than able to ascertain the root cause of what he called a mathematical anomaly. (Greenspan, in front of Congress, actually takes the time to explain forward rates to the politically committees thereby explaining how raising the Fed Funds rate should increase longer-rates, if only marginally.https://www.federalreserve.gov/boarddocs/hh/2005/february/testimony.htm) If the author, and others like him, would only concentrate on this more recent, and still unexplained, market / economic phenomenon, they would begin to better appreciate the forces that continue to exert significant downward pressure on U.S. interest rates.

In the respect for the time and space on this forum, I’ll will just shortly opine on these two pieces of economical statistics that more than stand in the way the author’s prognosticating statement. First, with regard to price indexes, it should be made well know that a clear deterioration in correlation between the U.S. GDP price deflator and consumer price indexes (both CPI and PCE) has arrived at the point where they are more independent of each other than they are related. More specifically, since 2009, the average correlation coefficient between the growth rates of CPI and GDP price indexes on a quarterly-annualized basis has been just 0.439 ( and 0.467 for PCE and GDP). By way of comparison, in the period leading up to the structural return of inflation, 1948-1964, that correlation coefficient was 0.860 (and 0.917 for PCE and GDP) and increased throughout the 1970s and early 1980s. Many economists are unfortunately taking the historical relationship between the price indexes for granted when instead they should be researching the significant breakdown between prices in the economy and prices at the consumer level.

Secondly, for every $1.00 in U.S. aggregate personal income earned today, only $0.55 is derived from compensation; a variable source of income. Back in 1965, subsequently, $0.70 of every $1.00 was driven by wages and salaries. Why is this important? Simply put, 45 percent of all income is coming from sources economically considered more “fixed” in nature. These sources included (as defined by the Bureau of Economic Analysis): Proprietor income, rental income, investment (dividends and interest) income, and government social transfers (Social Security and Medicare). As a result, pricing power remains extremely confined at this point in U.S. economic history and, based on the long-term economic fundamentals as personal income become even more “fixed”, it is only likely to get worse from here.

In conclusion, I think that you’ll eventually find that what the U.S. interest rate markets are currently experiencing is significant increase in price volatility and not the start of structural price inflation. Price volatility, as it were, that is always a natural economic consequence of a widening output gap. Consequently, as the U.S. economy continues to experience this economic procession (similar in nomenclature to its “recession” and “depression” counterparts, and economic procession is an economy that grows with the help of deflation at a pace increasingly below its long-term potential rate. It is easier to think of it like a parade, moving forward but never accelerating with any consistency.) I expect long U.S. Treasury yields to fall much further over time with the 30yr bond tumbling under 2.0 percent and perhaps even below 1.0 percent which will not only leave behind a flat, if not inverted, yield curve but another conundrum for many to either ponder or ignore.

Very Good and Timely article. Yes, a Large Bond Bubble and one that has a long way to go on the Down Side, significant losses to come.

We have two types of Bonds, those that are in Default and those that will go into Default.

Too much Debt has been issued and on poor fundamentals and the ability to pay and service the debt. The buyers of Bonds have ignored Risk and the fundamentals.

Yields will move higher over time, reflecting Risk and Defaults. Central Banks do not set the rates the Markets set the rates and the Central Bank shall follow. On the latest Fed rise, the Market moved first, Fed followed.

Its not Inflation Its Deflation and Deflation is and has taken hold and will do great damage to the Debt and Debt MKTS.

Bottom Line Bonds are in for significant losses and many will be illiquid.