Simon Lloyd and Ed Manuel

Central banks don’t just care about what is expected to happen. They also care about what could happen if things turn out worse than expected. In line with this, an emerging literature has developed models for measuring and predicting overall levels of macroeconomic risk. This body of work has focused on estimating the level of ‘tail risk‘ in a country by monitoring a range of domestic developments. But this misses a key part of the picture. In a recent Staff Working Paper, we show that monitoring developments abroad is as important as monitoring developments at home when assessing the vulnerability of the economy to a severe downturn.

Why we care about tail risks

Economic tail events like the global financial crisis (GFC) are rare but can have particularly damaging effects on society. Since the GFC, central banks have developed a range of macroprudential policy tools to address fault lines in the financial system to avoid a similar crisis. These tools are generally aimed at risk management: reducing the overall level of tail risk, rather than simply stabilising the economy during normal times.

Introduction to GDP-at-Risk

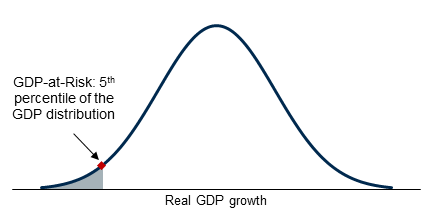

For macroprudential policy makers in particular then, it is important to be able to measure the overall level of economic tail risk over time. One popular summary measure of overall macro risk is ‘GDP-at-Risk’. GDP-at-Risk captures the severity of a possible ‘bad’ economic downturn – for our purposes we define it as the level of GDP growth associated with a ‘1-in-20’ bad outcome (or in technical terms, the 5th percentile of the conditional GDP growth distribution – Chart 1). When we say that GDP-at-Risk has worsened this means the probability of bad economic outcomes has gone up (ie the left tail of the GDP distribution moves further left).

Chart 1: GDP-at-Risk on a distribution of possible GDP outcomes

Unfortunately, GDP-at-Risk is not something we can directly observe. So we need a model to estimate its level over time and also understand its drivers. Recent literature has sought to do exactly that (eg Adrian et al (2018), (2019); Aikman et al (2019)). These studies have found that financial developments in the domestic economy – eg shifts in financial markets or the rate of credit growth – have a significant influence on GDP-at-Risk. For example, a credit boom could be a signal of excessive risk taking in the financial system, which could lead to a financial crisis (Bordalo et al (2018)).

Why we think foreign developments matter

But these approaches miss an important part of the picture. We know that events abroad can ‘spill over’ to the domestic economy, both positively and negatively. The GFC, in particular, serves as an example of how vulnerabilities in one country – eg in the US housing market – can have significant spillover effects, triggering an economic crisis around the world.

So it’s not just domestic financial developments, but also financial developments abroad, that we’d expect to influence GDP-at-Risk (eg Eguren-Martin and Sokol (2019)). When vulnerabilities are elevated abroad, this increases the risk of severe downturns in other countries – and, in turn, this could spill over to the domestic economy through a number of channels summarised in Figure 1. Although some of these foreign vulnerabilities may already be reflected in correlated domestic indicators (eg domestic financial conditions), some may not. So we set out to identify the additional contribution of foreign developments to GDP-at-Risk over and above domestic ones.

Figure 1: Stylised transmission of foreign vulnerabilities to domestic GDP-at-Risk

Our approach: why looking abroad makes things more challenging

In our paper, we propose a new methodology to account for these foreign vulnerabilities when assessing risks to the domestic economy. Like other studies, we rely on ‘quantile regression’, a statistical tool, to estimate the historical relationship between a range of indicators and the whole distribution of GDP growth – including GDP-at-Risk – over time, as well as the contribution of different variables to our estimates.

An immediate challenge we run into when trying to assess the contribution of foreign developments to domestic GDP-at-Risk is that this potentially involves feeding a lot more data into the model. For example, suppose you think it’s not just domestic credit growth, but also credit growth in other countries that has an influence on domestic tail risks. One approach would be to use data on domestic credit growth alongside credit growth in every other country in the model. But this would mean feeding the model a lot of variables – as the left-hand side (LHS) of Chart 2 highlights. This adds complexity, with the quantile regression effectively unable to unpick the contribution of different variables to GDP-at-Risk (an issue dubbed the ‘curse of dimensionality’).

Chart 2: We limit the data fed into our model by constructing foreign-weighted variables

Our solution is to condense variables in other countries into a single ‘foreign-weighted’ indicator. We construct these indicators as a weighted average of variables in each foreign country, putting a higher weighting on countries with closer ties with the domestic economy (eg using data on countries’ trade or financial linkages).

This significantly cuts down the number of variables we feed into the model. For example, if we’re interested in estimating the impact of heightened credit growth – both domestically and abroad – on UK GDP-at-Risk, we only need to use two variables (domestic credit growth and foreign-weighted credit growth; right-hand side (RHS), Chart 2).

Our findings: foreign developments matter (over and above domestic)!

Using our approach, we investigate the influence of foreign financial developments on domestic GDP-at-Risk, answering three questions:

a) Which variables matter for monitoring domestic tail risks, and over what time periods?

Foreign financial conditions and foreign credit growth have a significant association with domestic GDP-at-Risk. The association between these variables and GDP-at-Risk differs across horizons: tighter financial conditions signals a higher probability of bad domestic economic outturns (ie lead to a ‘worsening’ in GDP-at-Risk) around 1–2 quarters ahead (LHS, Chart 3). In contrast, rapid credit growth abroad increases the probability of bad domestic economic outturns around 1–3 years ahead (RHS, Chart 3).

Chart 3: Effect of a one standard deviation rise in each foreign variable on domestic GDP-at-Risk

b) Do foreign variables improve our ability to monitor domestic tail risks?

Adding foreign variables into the model improves our ability to track tail risks. We perform goodness-of-fit tests for quantile regression models and find that including foreign variables in the model leads to a significant improvement in GDP-at-Risk estimates.

Unlike a recent paper, we also find that our model is able to predict intuitive shifts in the shape of the GDP distribution in the run-up to crisis episodes – in part because we account for foreign developments. Chart 4 highlights some of these findings. These charts show estimated distributions of UK (LHS) and German (RHS) GDP growth on the eve of the GFC – one from a ‘domestic-only’ model which only uses domestic variables (blue) and one from our ‘full’ model which uses both domestic and foreign variables (green). For the UK, we find that the full model estimates a much larger rise in tail risk in the run-up to the GFC than the restricted domestic-only model. We estimate a value for UK GDP-at-Risk that is about two times more negative around two years prior to the start of the downturn when we include foreign variables. For Germany, the results are even starker. Here, only the full model is able to pick up a worsening in tail risk pre-GFC, with the domestic-only model failing entirely to provide a warning signal of the upcoming crisis.

Chart 4: Estimated distributions of future UK and German GDP growth pre-GFC

Notes: Dots show estimates of two year ahead GDP-at-Risk. Grey and blue lines show estimates from foreign-augmented model from 1996 Q4 and 2006 Q4, respectively. Green line shows estimate from domestic-only model from 2006 Q4.

c) What fraction of domestic GDP-at-Risk is causally driven by foreign developments?

While the previous questions focus on monitoring GDP-at-Risk, this question considers the causal influence of foreign variables on GDP-at-Risk. This is trickier to answer. The issue is that foreign and domestic variables tend to move closely together (see Chart 2). So separating out the relative causal impact of each requires us to make an assumption about the direction of causality between the two.

To address this, we extend our model and assume that foreign variables affect domestic ones on impact, but not vice versa (a standard ‘small open economy’ assumption). This allows us to decompose GDP-at-Risk estimates into contributions from foreign and domestic ‘shocks’. Chart 5 shows such a decomposition for UK GDP-at-Risk and highlights the significant role of foreign credit growth, in particular in driving a worsening in UK tail risk in the run-up to the GFC. On average, foreign shocks drive around 70% of the variation in advanced economies’ GDP-at-Risk (at the three-year horizon).

Chart 5: Decomposition of three year ahead UK GDP-at-Risk into foreign and domestic shocks

Conclusion

Our model highlights the crucial role of developments abroad for domestic economic tail risks. We show that when seeking to track the overall levels of tail risk, monitoring events abroad can offer important information over and above domestic indicators.

Simon Lloyd works in the Bank’s Global Analysis Division and Ed Manuel works in the Bank’s Macroprudential Strategy and Support Division.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.