Philippe Bracke and Alice Pugh.

Economic theory suggests that property prices and rents should move together: rents represent the flow of housing services gained from living in a property, and prices are determined by the discounted value of all future rents.

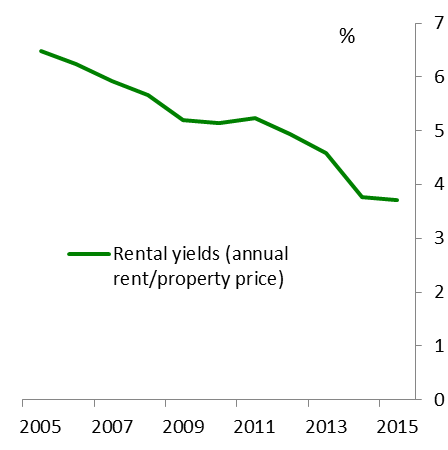

But data collected by LonRes show this has not been the case for Prime London. Whilst prices of rental properties have risen by 180% since 2005, rents charged have risen less than 40% (Chart 1). As a consequence, rental yields have fallen to between 3% and 4% (Chart 2).

Chart 1: Divergence between house prices and rents in Prime London

Chart 2: Rental yields in Prime London

What has driven this divergence? The most likely explanation seems to be an increase in competition between investors in the rental market. Whilst the number of buy-to-let transactions fell sharply during the crisis, it has since rebounded to around its pre-crisis levels. A higher number of properties available to let has meant that landlords have been unable to raise rents – whilst the prices paid to purchase these properties have risen sharply. Consistent with this theory, the LonRes data show that the median number of days it takes to rent a property has increased since the crisis, to over 50 days.

Philippe Bracke and Alice Pugh work in the Bank’s Structural Economic Analysis Division)

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied.

Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees

pound weakens, cost of imports increase. Inflation inevitably rises now that lag time has been spent. Probably reverting to 2011 levels of 5% (a 200% increase). If ones mortgage was variable at 6% per annum, what percent of change in the variable rate should be expected? What effect would that have on a £500k variable rate mortgage?

Great Points & Great Theory. It is interesting to note that of the two parts of your equation one side is rooted in reality and is somewhat “solid” – The RENTALS, while the other side is Purely Speculative and has no concrete Validity possible attaching to it.

How about thinking if its linked to the BOE rate – lower risk free rate ensures a lower rent risk premium?

It may be that house prices are more impacted by cheap credit and poor returns on other assets, combined with the view that at property being a physical asset is safer than paper assets. This explains the divergence from rents.