Noëmie Lisack, Rana Sajedi and Gregory Thwaites

How sound is the argument that current account balances are driven by demographics? Our multi-country lifecycle model explains 20% of the variation in observed net foreign asset positions among advanced economies through differences in population age structure. These positions should expand further as countries continue to age at varying speeds.

Persistent current account surpluses and deficits have made the headlines over the past few years. While many have highlighted the role of policy actions that can potentially lead to imbalances, structural characteristics can also explain large external positions in line with countries’ fundamentals. One such characteristic is the population age structure and its evolution. For instance, Germany mentions its relatively faster ageing population as a potential explanation for its large surplus. In 2018, the IMF revamped, among other things, the way that demographics are taken into account in its External Balance Assessment framework.

Is the link between demographics and a country’s external balance theoretically sound? How quantitatively important is this mechanism for explaining observed current accounts, and the resulting accumulation of net foreign asset (NFA) positions, in advanced economies?

Asymmetric ageing across countries

In a previous blog post, we described the effects of ageing in advanced economies highlighting that, as populations get older, wealth and capital increase and hence interest rates decline. This demographic trend is common to all advanced economies, but different countries are ageing at different speeds. While the old-age dependency ratio – the ratio of over 65 year-olds to 20-64 year-olds – is projected to rise above 60% on aggregate, this number reaches 75% in Japan, against 55% in the US, by 2100 (Figure 1).

Figure 1: Old-age dependency ratios across advanced economies

Source: UN Population Statistics (projections based on median-fertility scenario).

Theoretical implications for capital flows

How do these differences affect the current accounts of these open economies? Assuming no frictions in capital flows, one global interest rate would prevail ensuring that household wealth equals capital in the global aggregate economy. However, that will not necessarily imply that country-level domestic wealth and capital are equal. Capital flows can take place if a country’s domestic wealth differs from its capital stock. Put differently, the global interest rate determines the financing cost for firms and hence the capital that they demand; whether all this capital is supplied domestically will depend on the ageing of domestic households relative to the aggregate.

Concretely, consider the US, which is ageing more slowly than the average. Since ageing is putting less upward pressure on domestic US savings, the global real interest rate is below the interest rate that would hypothetically arise were the US a closed economy, all else equal. Hence, at the global interest rate, US household wealth is below US firms’ desired capital level. This leads to capital inflows into the US, as foreign households supply capital to US firms, and hence to a negative NFA position for the US. The opposite is true for a country ageing faster than the average, such as Japan or Germany, which would experience capital outflows leading to a positive NFA position.

From ageing asymmetries to external positions

To quantify this effect, in our working paper, we develop a multi-country overlapping-generations model, solved separately for each country. All countries are considered symmetric, except for differences in their population age structure over time. Firms and households in each country take the global interest rate path as given to decide how much capital to use and how much to save, respectively. This setup gives us a model-implied NFA position over time for each advanced economy, which is driven only by demographic differences.

Comparing the 2015 model-implied NFA/GDP ratio to the data gives a broad idea of the relevance of demographics for external positions. The variation in model-implied NFA positions across advanced economies captures around 20% of the variation observed in the data (Figure 2). Demographic differences thus play a significant role in determining NFA positions, though naturally there are other important factors as well. The model clearly does not capture the large liabilities of Portugal, Ireland, Greece and Spain, which in 2015 were driven by cyclical and fiscal factors, nor the large assets of Norway, driven by their position as an oil exporter. The fitted line is also slightly shallower than the 45-degree line, showing that the model tends to imply larger NFA positions than in the data, reflecting the existence of capital flow frictions in the real world that are not captured in the model.

Figure 2: Model-implied vs. observed net foreign assets (%GDP)

Note: NFA is Net Foreign Assets, grey line is the 45-degree line. Source: IMF IFS.

Expanding future external positions

Using the UN projections for demographic trends, our model can also give us predictions for external positions in the future. For this exercise, we capture the degree of ageing using the high-wealth ratio (HWR) – the ratio of over 50 year-olds to 20-49 year-olds. This ratio is most relevant for the effect of ageing on household wealth, because it measures the ratio of households in the ‘high-wealth’ period of life relative to those in the ‘low-wealth’ period.

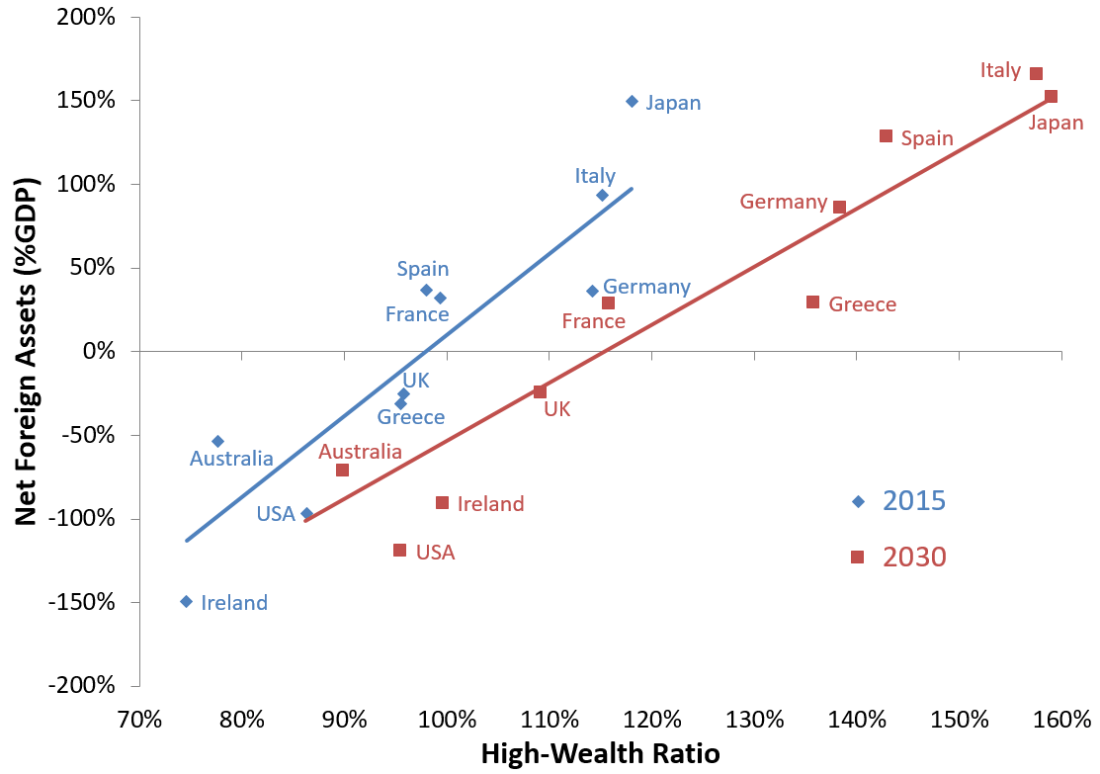

We consider how the model-implied NFA positions change as countries age (Figure 3). In line with the intuition laid out above, countries with more advanced ageing have higher NFA positions and countries with less advanced ageing have larger negative NFA positions. Going from 2015 to 2030, the HWR rises in all countries, as they all age. As this happens, the model predicts an increasing dispersion of NFA positions as countries continue to age at different speeds. We would therefore expect a large amount of capital flows between countries and widening external positions in the future.

Figure 3: Model-implied net foreign assets vs high-wealth ratio, 2015 and 2030

Note: High-Wealth Ratio: ratio of over 50 year-olds to 20-49 year-olds. The fitted lines use all 23 advanced economies in our sample.

Overall, large NFA positions do not necessarily mean large imbalances, after taking into account country-specific structural factors. Indeed, our model shows that demographics can be a significant factor driving persistently large external positions. Based on the model, the impact of population ageing is expected to persist and even expand over time, as population age structures are expected to further diverge.

This post was also published in French on the Banque de France’s blog Bloc-notes Éco.

Rana Sajedi works in the Bank’s research hub, Noëmie Lisack is a research economist at the Banque de France and Gregory Thwaites is Research Director at Founders Pledge.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.