Saleem Bahaj, Robert Czech, Sitong Ding and Ricardo Reis

Few topics captivate our attention like the enigma of inflation. Understanding where the market thinks inflation is headed is crucial for policymakers, investors, and anyone who wants to keep their financial ducks in a row. And that’s where inflation swaps come into play. They are like the crystal ball of inflation expectations, allowing traders to hedge against inflation risk and giving us a peek into the minds of market participants. In a recent paper, we delve into this thriving market to uncover the who, what, and why behind the prices of these swaps to shed light on the dynamics of inflation expectations.

Why, you might ask, are these swaps gathering such attention? Well, their significance lies in their ability to offer a complementary perspective on inflation expectations. While traditional measures such as breakeven inflation from index-linked government bonds have their merits, inflation swaps provide a complementary canvas for market participants to express their views on future price dynamics. By analysing these swaps, economists can refine their understanding of market sentiment and calibrate their decisions accordingly. Despite the market’s importance, not much is known about the relevant players and quantities behind the prices.

Inflation swap basics

But first, let’s go back to basics. Inflation swaps are derivative contracts that allow two parties to exchange a stream of payments at a fixed rate for another at a floating rate pegged to an inflation index (for example the UK Retail Price Index (RPI)). Most inflation swap contracts take the form of zero coupon swaps, where cash changes hands at the end of the contract. The majority of these contracts tend to mature at relatively short horizons (eg one to three years) or at long horizons of ten years or more.

The buyer of an inflation swap pays the fixed rate, which reflects the expected inflation at the contract’s end date. If inflation matches the fixed rate, no money changes hands, and both parties break even. The seller of an inflation swap pays the floating inflation rate. Since the actual inflation rate is uncertain, the seller’s liability is determined only at the end of the contract. When the realised inflation rate deviates from the fixed rate, one party has to compensate the other. For example, if realised inflation is higher than the fixed rate, the seller will owe the buyer at the end of the contract, and vice versa if realised inflation is lower than the fixed rate.

Unsurprisingly, the inflation swap market is not without its complexities. Market participants have different bargaining powers and risk-bearing capacities, and often demand extra compensation for trading such a risky derivative. This means that the swap breakeven rate not only reflects the markets’ pure inflation expectations, but is also likely contaminated by a liquidity premium – a catch-all term for market imperfections that can be large and vary over time. Given so, how useful are these swap breakeven rates as a measure of expected inflation?

Stylised facts on the market for inflation swaps

To lift the lid on this market, we harness the regulatory DTCC EMIR Trade Repository Data to obtain detailed trade-level reports on over-the-counter inflation swap contracts. The inflation measure for the UK inflation swap market is the RPI, which dominates nearly all (around 99%) swap contracts traded on UK inflation – consistent with the RPI’s role as the index used for inflation-linked gilts. Taking a closer look at the UK RPI swaps, one of the key facts that we document is the segmentation within the market. Pension funds and LDI funds emerge as the primary buyers of inflation protection, holding substantial positive net positions (predominantly at longer horizons of more than 10 years). Dealer banks, who are on the other side of the trade, actively sell inflation protection beyond their holdings of inflation-linked gilts. Hedge funds actively engage in short-horizon trading (≤ three years), leading to daily fluctuations in their net positions. This market segmentation sheds light on the strategies and trading motives of market participants across different trading horizons: hedge funds seem to engage in informed arbitrage trading in the short-horizon market, while pension funds seek to hedge their long-dated liabilities by buying inflation protection in the long-horizon market. As a result, dealer banks end up as substantial net sellers of inflation protection (as shown in Chart 1).

Chart 1: Net notional positions in the UK RPI inflation swap market

Source: DTCC Trade Repository OTC interest rate trade state files, from January 2019 to February 2023.

Our identification strategies

Backed by a theoretical model, we decompose swap prices into two components: (i) a liquidity premium; and (ii) a ‘fundamental’ component of inflation expectations. To estimate these components, we employ three different identification strategies, each leveraging different features of the data.

First, we take advantage of the high-frequency nature of our data and assume that hedge funds respond more to fundamental shocks than dealer banks within a trading day. Dealer banks, in turn, react more than pension funds to these shocks. This means that a fundamental shock resembles a demand shock in the short-horizon market (both prices and quantities rise) and a supply shock in the long-horizon market (prices rise but quantities fall). We also assume that demand shocks to the short-horizon market do not spill over to the long-horizon market within a trading day, and vice versa. Importantly, we are able to verify these assumptions in the data. Using a sign restriction approach, we are then able to identify supply, demand and fundamental shocks by observing fluctuations of prices and quantities in the swap market.

Second, we leverage the variation across market participants to construct granular instrumental variables, using investor-level shocks as instruments for the aggregate demand of each sector.

Finally, we exploit the fact that inflation swap rates exhibit larger fluctuations on inflation release dates. Assuming that these dates are dominated by fundamental shocks, we can use price movements over time to identify these shocks. For all three identification strategies, we then estimate vector autoregressions.

Results and policy implications

Our empirical analysis yields several robust findings across the three identification strategies. First, we find that all swap rates stabilize within two to three trading days after a fundamental shock. In other words, the inflation swap market seems to incorporate new fundamental information rather quickly. Second, the supply of inflation protection by dealer banks to pension funds at long horizons is very elastic, unlike their supply to hedge funds at short horizons. This means that shocks to the demand of pension funds determine the traded quantities in the long-horizon market, but are unlikely to have a significant impact on prices. Third, most of the movements in short-horizon swap prices are driven by liquidity frictions, particularly by shocks to the demand of hedge funds. Our results therefore suggest that short-horizon swap rates are relatively unreliable measures of expected inflation. In contrast, fundamental factors dominate price movements in the long-horizon market. This suggests that changes in the 10-year inflation swap rate are a better measure of fundamental expected inflation.

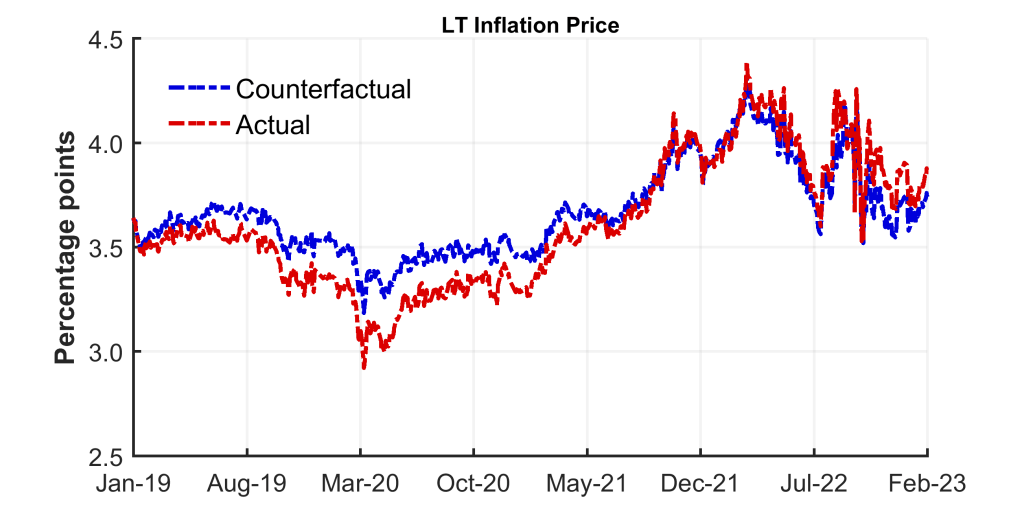

Moreover, we provide a novel time series for long-horizon fundamental expected inflation that is cleaned of liquidity frictions (see Chart 2). Our counterfactual estimates of expected long-term inflation suggest that an unfiltered reading of actual inflation swap prices will lead to an overstatement of movements in expected inflation. For example, actual measures overstated the risk of deflation during the pandemic, and they equally overstated the risk of sustained inflation during the energy crisis. In fact, our counterfactual measure of expected fundamental inflation has been lower and declining more rapidly than actual swap rates since Autumn 2022. Our counterfactual measure therefore suggests that long-run expectations of inflation are more stable than implied by actual swap rates alone.

Chart 2: Fundamental expected inflation

Finally, we find a significant dispersion in the beliefs about inflation among dealer banks and hedge funds. In the short-horizon market, we show that a handful of institutions respond to fundamental changes in inflation expectations by taking far larger positions in the market. This implies that their trading behaviour is likely to determine swap prices. In the long-horizon market, in contrast, pension funds tend to have more uniform beliefs and their price impact is more evenly distributed. Intriguingly, the inflation beliefs of individual dealer banks inferred from trading activity also line up remarkably well with their one-year inflation forecasts: the dealer banks that submit higher inflation forecasts tend to sell less inflation protection to hedge funds in the short-horizon market.

Conclusion

Understanding the dynamics of the inflation swap market is useful for policymakers and market participants alike. By shedding light on the key players, market dynamics, and expectations, we reveal the swift reactions of market participants to new information, the role of different institutions in trading inflation protection, and the impact of liquidity frictions and fundamental factors on price movements. These insights provide valuable guidance for understanding inflation expectations and making informed decisions in a rapidly changing economic landscape.

Saleem Bahaj works in the Bank’s Research Hub division and is an Associate Professor of Finance and Economics at University College London. Robert Czech works in the Bank’s Research Hub. Sitong Ding is a PhD student at the London School of Economics and Ricardo Reis is the A. W. Phillips Professor of Economics at the London School of Economics.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.